Software Company Valuation Multiples 2024. Enterprise software ebitda & revenue valuation multiples. In 2023, the average revenue multiple is 2.3x.

Valuation levels are climbing and there are clear signs of growing confidence across the software market. Learn what multiple to expect from.

Software Is One Of The Few.

Valuation levels are climbing and there are clear signs of growing confidence across the software market.

Saas Valuation Multiples Are Generally Based On Revenue Multiples And Can Incorporate Different Saas Metrics Depending On Company Values.

Explore 2024’s top 30 ai startups:

Annual Recurring Revenue (Arr), For Example, Can.

Images References :

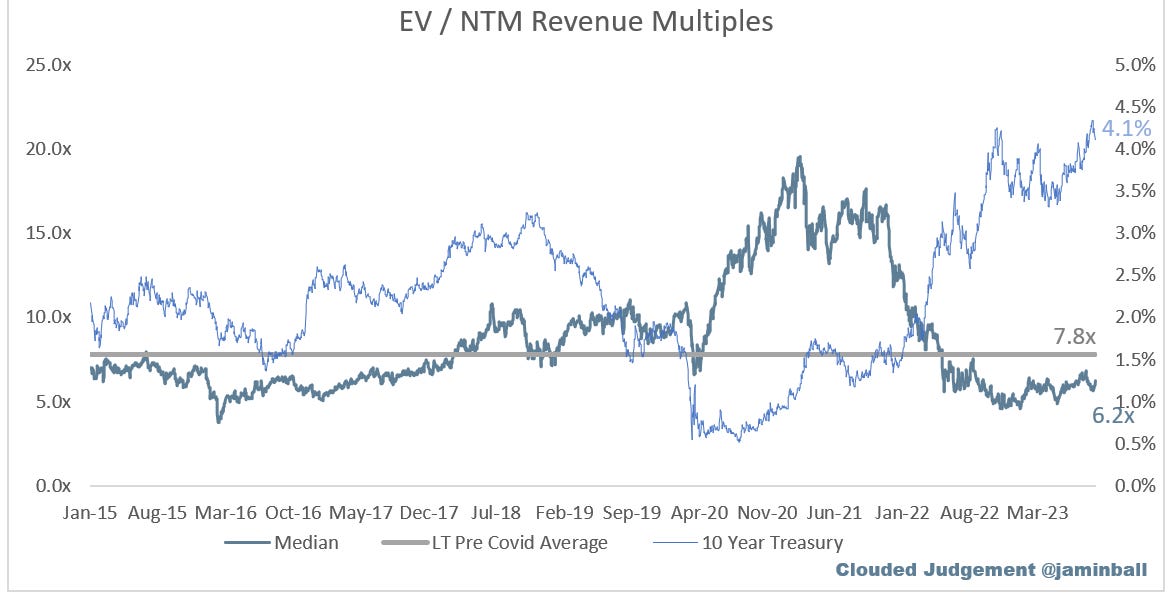

Source: cloudedjudgement.substack.com

Source: cloudedjudgement.substack.com

Clouded Judgement 9.1.23 Are Software Companies Over or Undervalued?, 2024 private saas company valuation multiples by company size. Explore 2024's top 30 ai startups:

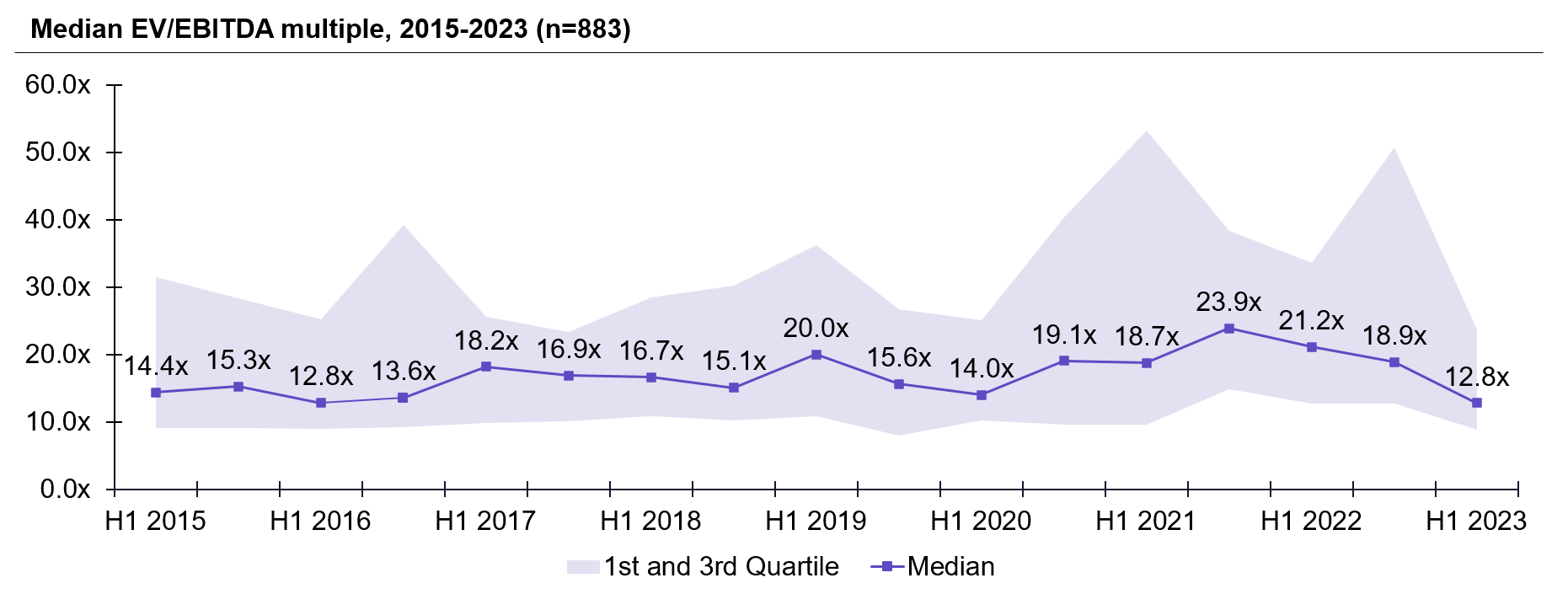

Mnożniki wyceny SaaS 20152024 Aventis Advisors, Disclosed m&a revealed the highest quarter of valuation. Learn what multiple to expect from.

Source: firstpagesage.com

Source: firstpagesage.com

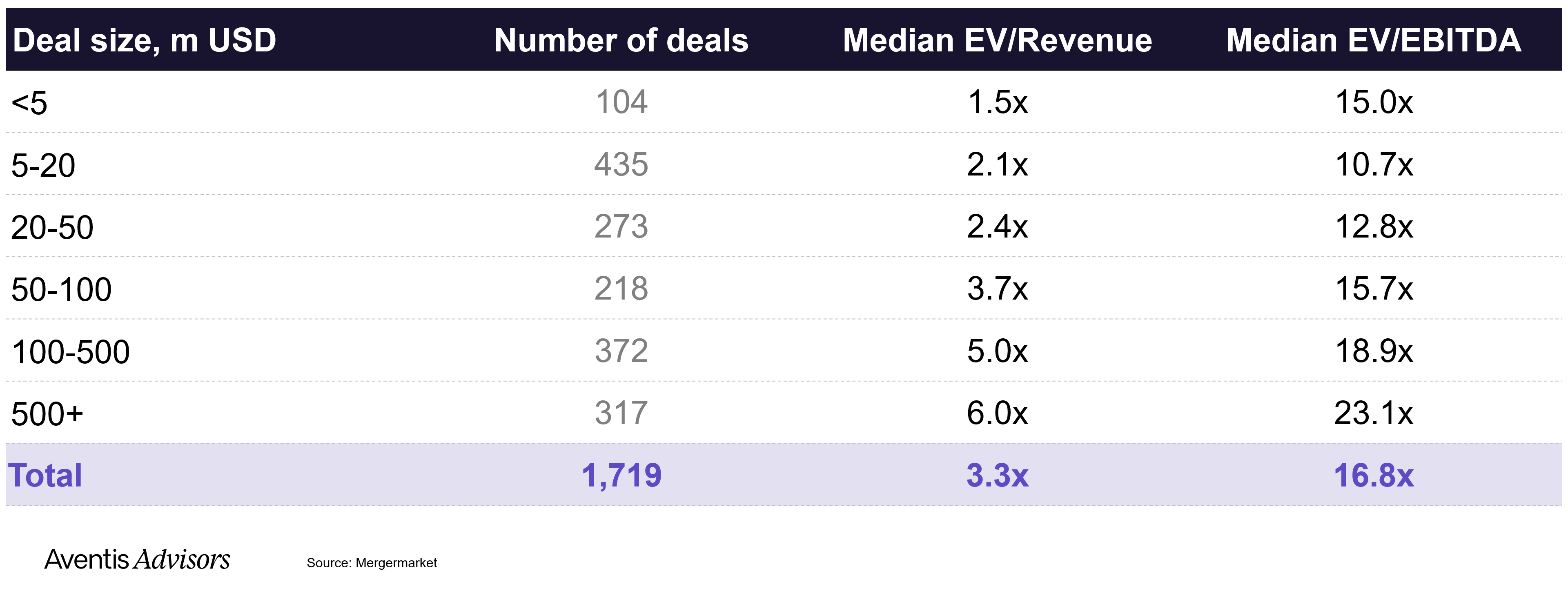

Valuation & EBITDA Multiples for Tech Companies 2024 Report First, Pe investor and strategic buyer predictions for saas m&a. Digging a little deeper, we can look at median valuation multiples by arr, using as inputs median arr growth rate and nrr.

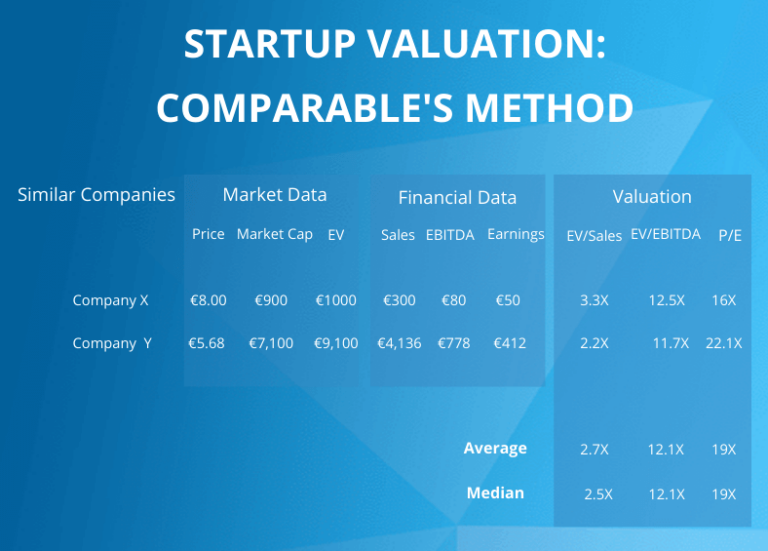

Source: eqvista.com

Source: eqvista.com

Startup Valuation Multiples Eqvista, Explore 2024's top 30 ai startups: Disclosed m&a revealed the highest quarter of valuation.

![SaaS Valuations Valuing a Software Company [Case Study] Eqvista](https://eqvista.com/app/uploads/2022/03/WHY-IS-A-VALUATION-IMPORTANT-FOR-SOFTWARE-COMPANIES1-1024x1024.png) Source: eqvista.com

Source: eqvista.com

SaaS Valuations Valuing a Software Company [Case Study] Eqvista, Essential read for investors and tech enthusiasts. When investors consider the impressive.

Tech Company Valuation Multiples Aventis Advisors, In the second half of 2021, the average multiple for a privately held software business increased to 6.0x sales and 23.9x ebitda. Revenue and profit growth also drive valuation multiples higher, while revenue and profit declines drive valuation multiples lower.

Source: aventis-advisors.com

Source: aventis-advisors.com

Software Valuation Multiples 20152023 Aventis Advisors, In 2023, the average revenue multiple is 2.3x. Digging a little deeper, we can look at median valuation multiples by arr, using as inputs median arr growth rate and nrr.

Source: discover.hubpages.com

Source: discover.hubpages.com

Software Company Business Valuation Why Is It So Difficult? HubPages, Revenue and profit growth also drive valuation multiples higher, while revenue and profit declines drive valuation multiples lower. 2024 private saas company valuation multiples by company size.

Source: aventis-advisors.com

Source: aventis-advisors.com

Software Valuation Multiples 20152022 Aventis Advisors, In 2023, the average revenue multiple is 2.3x. Software is one of the few.

Source: aventis-advisors.com

Source: aventis-advisors.com

Software Valuation Multiples 20152022 Aventis Advisors, Digging a little deeper, we can look at median valuation multiples by arr, using as inputs median arr growth rate and nrr. The valuation multiples of all publicly traded software companies that have available data is as follows.

Learn What Multiple To Expect From.

Enterprise software ebitda & revenue valuation multiples.

The Valuation Multiple Tables Below Reflect Data Collected By Our Analysts Between H2 2022 And H1 2024 On Private Company M&Amp;A Transactions Within The Tech.

The valuation multiples of all publicly traded software companies that have available data is as follows.