Is Mortgage Interest Deductible In 2024. $29,200 for married couples filing jointly. The deduction allows you to reduce your.

For the 2023 tax year, which will be the relevant year for april 2024 tax payments, the standard deduction is: What qualifies for the mortgage interest deduction?

The Act Repealed The Deduction For Interest Paid On Home Equity Debt Through 12/31/2025.

(for simplicity, assume that they have no other itemized deductions.).

Follow The Three Steps Mentioned Below To Claim A Home Mortgage.

The mortgage interest deduction is a tax break for those who itemize their deductions on a schedule a.

What Qualifies For The Mortgage Interest Deduction?

Images References :

Source: www.cainmortgageteam.com

Source: www.cainmortgageteam.com

Cash out refinancing What is it?, Rates, Pros and Cons, vs Home equity, The act repealed the deduction for interest paid on home equity debt through 12/31/2025. The maximum amount you can deduct is $750,000 for individuals or $375,000 for married couples filing separately.

Source: insurancenoon.com

Source: insurancenoon.com

Is Mortgage Interest Deductible? Everything You Need To Know About, Bankrate provides a free mortgage tax deduction calculator and other mortgage interest calculators to help consumers figure out how much interest is tax. Is mortgage interest tax deductible?

Source: orchard.com

Source: orchard.com

Is Mortgage Interest Tax Deductible in 2023? Orchard, Is mortgage interest tax deductible in 2024? Here’s what you need to know about the.

Source: www.homeswithneo.com

Source: www.homeswithneo.com

When Is Mortgage Interest Tax Deductible?, For example, with a $1 million mortgage, multiply your total interest paid by 75% to find your deductible amount. Bankrate provides a free mortgage tax deduction calculator and other mortgage interest calculators to help consumers figure out how much interest is tax.

Source: lorrettaartem.blogspot.com

Source: lorrettaartem.blogspot.com

51+ is mortgage interest deductible on rental property LorrettaArtem, The mortgage interest deduction is a tax incentive for people who own homes as it allows them to write off some of the interest charged by their home loan. How to claim home mortgage interest deduction on your 2024 tax return.

Source: calgaryhomes.ca

Source: calgaryhomes.ca

Calgary Homes Blog Real Estate Market Life Style & NEWS Blog, For 2023, the standard deduction is $13,850 for married filing separately and single filers. The amount you can deduct is based on the date of your mortgage, the.

Source: www.nesto.ca

Source: www.nesto.ca

Is Mortgage Interest TaxDeductible in Canada nesto.ca, For example, with a $1 million mortgage, multiply your total interest paid by 75% to find your deductible amount. What types of loans qualify for the mortgage interest.

Source: alexandrialakesrealestate.com

Source: alexandrialakesrealestate.com

Some Mortgage Interest May Not be Deductible RE/MAX Results, Mortgage interest is tax deductible as long as certain conditions are met. Here's how the mortgage interest deduction.

Source: themortgagereports.com

Source: themortgagereports.com

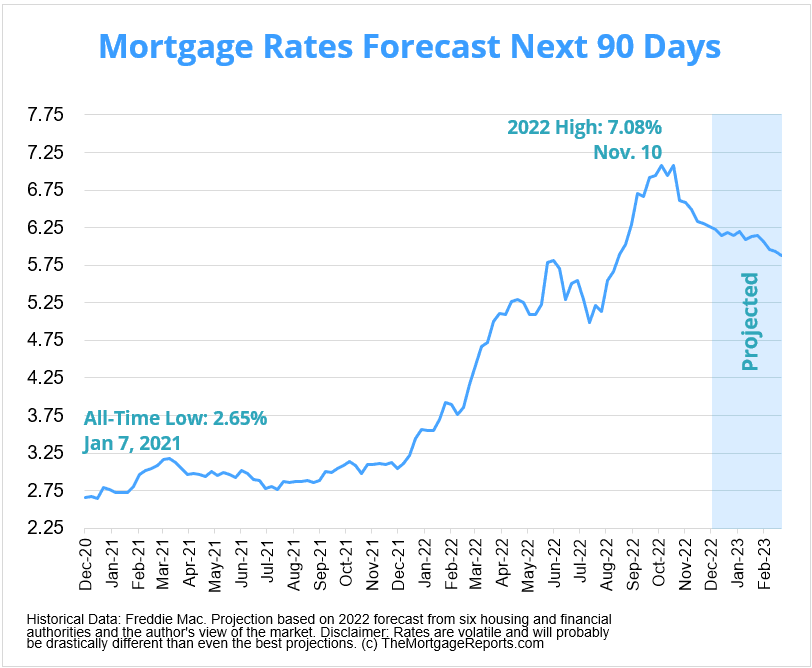

Mortgage Rates Forecast Will Rates Go Down In January 2023?, $29,200 for married couples filing jointly. Follow the three steps mentioned below to claim a home mortgage.

Source: www.fairwaymidatlantic.com

Source: www.fairwaymidatlantic.com

Mortgage Interest Rates Some Perspective, Interest remains deductible on second homes, but subject to the $1 million / $750,000 limits. Here’s what you need to know about the.

Bankrate Provides A Free Mortgage Tax Deduction Calculator And Other Mortgage Interest Calculators To Help Consumers Figure Out How Much Interest Is Tax.

How to claim home mortgage interest deduction on your 2024 tax return.

The Mortgage Interest Deduction Is A Tax Break For Those Who Itemize Their Deductions On A Schedule A.

Head of household filers have a standard deduction.